Decoding the Hermès Lawsuit: Exclusivity on Trial

The Hermès lawsuit has rocked the luxury goods market. A Birkin bag controversy in California has led to allegations of worldwide Hermès monopoly and a class-action lawsuit. What’s going on here?

The Hermès Birkin bag is undoubtedly the most coveted luxury handbag on the planet. According to the latest Hermès price increase, the smallest Birkin bag in standard leather starts at $11,400, and prices skyrocket from there. At auction, elite Hermès bags like the Birkin can sell for $350,000 to $500,000. While collectors prize the bag’s meticulous artisanship and chic style, these are not the only reasons Birkin bags are so expensive. Hermès has carefully crafted an enormously successful strategy of exclusivity. And now, they’re being sued for it.

Why is Hermès Being Sued?

Two Californians, each with a history of shopping with Hermès, encountered frustration familiar to any of the atelier’s devotees — they were not offered a Birkin bag to purchase. What they did about it made international news. Tina Cavalleri and Mark Glinoga filed a class action Hermès lawsuit, alleging the luxury brand violated antitrust laws by requiring customers to buy other products in order to purchase a Birkin bag.

The plaintiffs allege that, in essence, an “Hermès monopoly” was formed when customers are required to buy one product in order to qualify to purchase another. “Consumers are coerced into purchasing ancillary products from [Hermès]” to qualify to purchase a Birkin, reads the complaint. “This is anti-competitive, tying conduct.”

The Hermès lawsuit states, “Most consumers will never be shown a Birkin handbag at Hermès retail store.” The filing continues, “Typically, only those consumers who are deemed worthy of purchasing a Birkin handbag will be shown a Birkin handbag. For all practical purposes, there is no way to order a bag in the style, size, color, leather, and hardware that a consumer wants.”

Does Hermès Require Other Purchases for a Birkin Bag?

As avid collectors know all too well, a customer is indeed expected to “establish a sales profile” by making purchases across a broad cross-section of Hermès categories before being offered the chance to purchase one of their flagship bags. The money spent and the products purchased, such as shoes, fragrances, housewares, and jewelry, are called the Hermès pre-spend. Online forums are devoted to discussions of “Birkin bait,” insiders’ slang for the items purchased in hopes of one day securing the chance to buy a Birkin or the other “Holy Grail” Hermès purse, the Kelly bag.

Despite many theories and significant Hermès controversy, no one knows for sure what brand products must be purchased or how much money must be spent to score the coveted opportunity to buy the Birkin. Some have spent upwards of $50,000 before getting their first chance, while others have spent just $20,000. There are even some lucky few who report walking into a boutique for the first time and then walking out with a Birkin bag, though few believe their stories.

There is no doubt that Hermès often requires a customer to make many (many) other purchases before being “deemed worthy” of purchasing a Birkin or a Kelly bag. But is that illegal?

The Cost of Exclusivity

There is no denying that the road to buying a Birkin bag from Hermès is an arduous one. This results from a deliberate brand strategy to protect and grow the exclusivity of their flagship products. There are four primary pillars of the Hermès exclusivity building strategy:

- High prices with frequent increases

- Strictly limited production, well below demand

- Hermès quota bag system, limiting purchases to two Birkins or Kelly bags annually

- Steep and mysterious pre-send requirements before the opportunity to purchase a Birkin or Kelly

By deliberately limiting access to their flagship bags in this way, Hermès has successfully driven demand for these bags stratospheric. Kelly bags and Birkins routinely sell for $30,000 to $300,000 on the resale market.

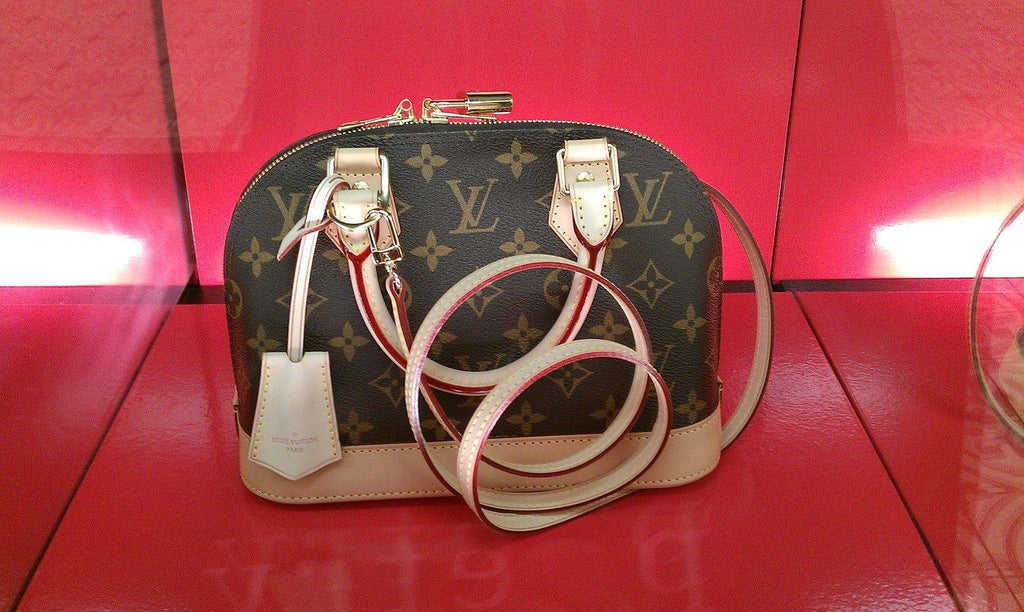

The Hermès exclusivity strategy has been avidly copied by other luxury brands, eager for a taste of Hermès’ extreme success. Chanel, Louis Vuitton, and Pharrell Williams, among others, also reward customers for massive and diverse spending with exclusive access to their most iconic designs.

What the Hermès Lawsuit Says

The Hermès lawsuit alleges that the scarcity strategy and pre-spend requirement are illegal. The plaintiffs claim that Hermès violates antitrust laws by requiring customers to purchase other products before qualifying to buy a Birkin bag. "The unique desirability, incredible demand, and low supply of Birkin handbags gives [the brand] incredible market power," the filing reads. "Defendants [Hermès] implemented a scheme to exploit this market power by requiring consumers to purchase other, ancillary products from [them] before they will be given an opportunity to purchase a Birkin handbag. With this scheme [the brand was] able to effectively increase the price of Birkin handbags and, thus, the profits that Defendants earn from Birkin handbags."

Legal Experts Response to the Birkin Bag Lawsuit

The Hermès lawsuit or the “Birkin bag lawsuit” has attracted the interest of legal experts, most of whom expect the French luxury brand to come out on top. To win, the plaintiffs must prove an Hermès monopoly exists as a result of illegally tying the purchase of a Birkin to the purchase of other products. Legal analysts doubt the plaintiffs will be successful, pointing out that the only monopoly Hermès enjoys is over its own product line. Further, while the pre-spend may constitute “tying” the purchase of one item to others, this is not always illegal. Since the luxury brand never spells out the policy and implements it inconsistently, the plaintiffs will struggle to make their case.

Some even wonder whether the Hermès lawsuit is intended to succeed in court. The filing is riddled with errors that may undermine its success. In addition to multiple misspellings of “Birkin,” the complaint mistakenly alleges that all Hermès products are sold on its website except for the elusive Birkin. In fact, relatively few Hermès products are listed for sale online, and just two of their more than 80 handbag styles can be purchased this way. This is a common practice for luxury handbags, repeated by Chanel, Goyard, and Louis Vuitton. The counsel representing the Plaintiffs apparently has little experience with luxury retail brands.

Like the luxury brand’s fans the world over, we shall watch the Hermès lawsuit with keen interest.